- Home »

- Insights »

- Global CIO View »

- Equities »

- Emerging-markets equities – time to revisit

Lately, China watchers have had plenty to ponder. In recent months, better liquidity support for the property sector, favorable news on rules governing foreign listings, and friendlier policies for the private sector dominated internet businesses have completely turned sentiment. The dramatic U-turn in Covid-19 strategy, looks set to boost domestic growth in gross domestic product (GDP). We were especially encouraged that the rapid re-opening post Chinese New Year did not trigger additional Covid waves.

While domestic and geopolitics certainly remain wild cards, the fundamentals have clearly improved and there are growing signs that domestic economic stability is a key policy priority over the coming 12 months. Going forward, we would expect China’s recovery to accelerate, with economic data improving in the second quarter of 2023. We expect government policies to remain supportive for growth in consumption and a pickup in services. Pent-up Chinese demand is likely to also strengthen goods and services trade in the region, not least thanks to the return of tourists from mainland China. Investments should continue not only in infrastructure but also in the decarbonization of the economy. Urbanization remains another key driver as China strives to bring the urbanization rate up to 80% from the current 63%.

While momentum may surprise on the upside this year, China’s medium-run growth rate is likely to normalize around a much lower trend than in previous decades. On top of demographic challenges in a medium-income country, the Chinese economy could also continue to face the same challenges prior to Covid-19, from weakness in its property market and local government finances to geopolitics.

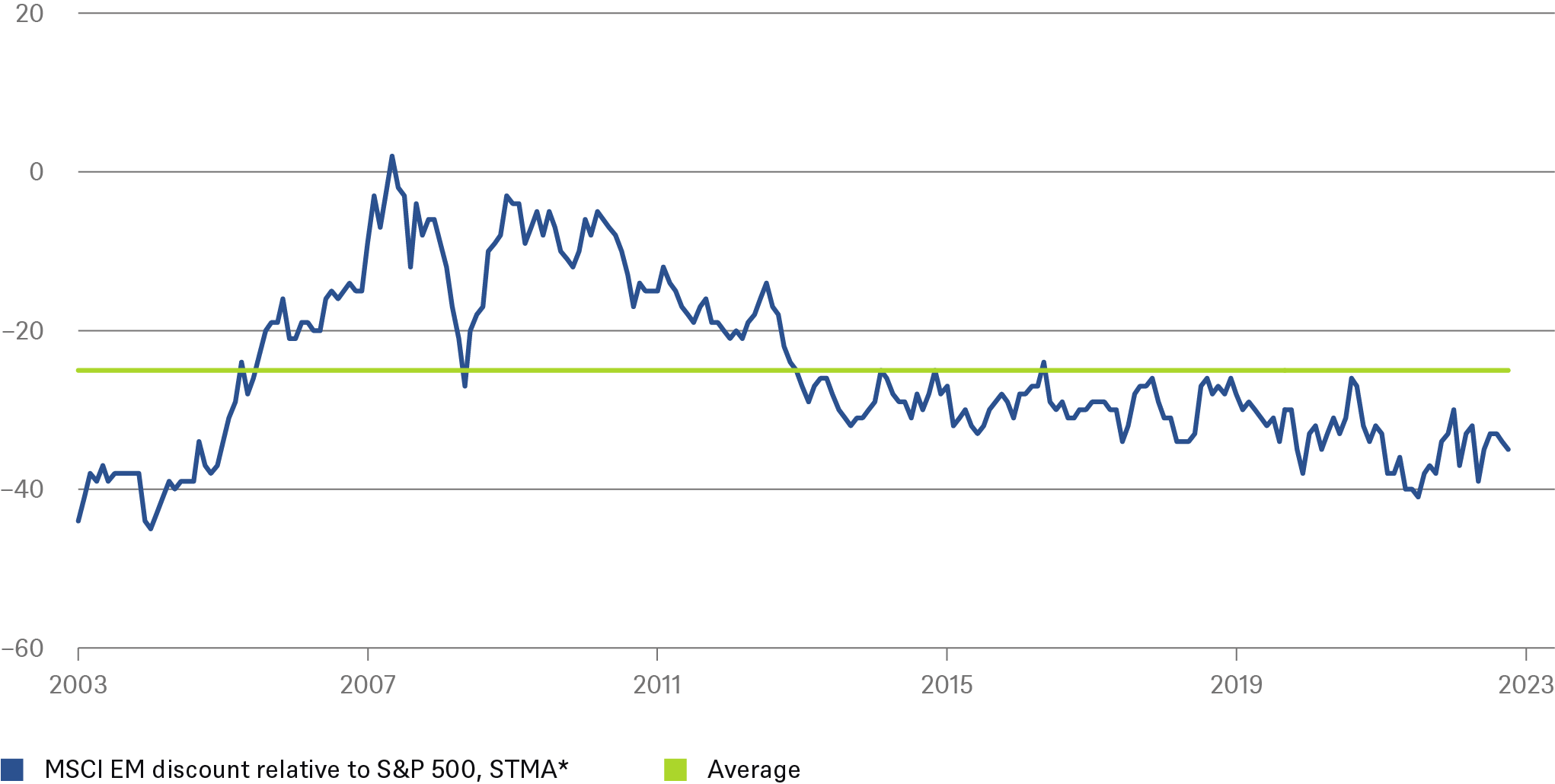

Valuation discount EM vs. U.S. equities

%

Source: DWS Investment GmbH, FactSet Research Systems Inc. as of 3/31/23

Despite this, and recent wild swings in financial markets, we think that the China rally still has a lot further to go. The Chinese equity market has come down a long way since February 2021. More broadly, emerging markets (EM) remain cheap and investors’ positioning from global funds stay light after they reduced their positions last year. In our view, earnings momentum should also prove rather better over the medium term than in developed markets.

Clearly, foreign investors have been unsettled by last year’s policy headwinds in China. These offer an excellent broader lesson for emerging-markets investors. With countries that are governed in their own distinct ways, political surprises of both a negative and a more benign kind should always be expected. One key to investment success is to know when to look beyond past policy disappointments.

Despite occasional geopolitical flare-ups, we would expect foreign investor concerns to dissipate quickly, if and when economic data continues to improve in line with our expectations. China’s governance model has long combined top-down direction with bottom-up autonomy. It remains to be seen whether President Xi Jinping will prove willing and able to reopen the political system’s feedback channels to the extent necessary to ensure their efficient functioning over the longer term[1]. In the meantime, however, investor preferences appear well aligned with the pro-business reset China’s rulers have lately favored.