- Home »

- Insights »

- Global CIO View »

- Macro »

- European Transformation – finally, Europe gets a makeover

Better late than never. As we have long argued, European economies urgently need a makeover[1]. If done properly, the shift towards digitalization and renewable energy have the potential to transform Europe’s prospects, as indeed, the continent’s north-eastern edge has already seen significant progress (see theme 2). Elsewhere, it took Vladimir Putin’s latest war on Ukraine and the resulting cost-of-living crisis to bring home the urgency of reducing external dependencies and build sustainable economies.

If Europeans wish to secure their current high standard of living and lay the foundations for future prosperity, significant investments will be required, creating opportunities for private investors. By 2030, the European Union (EU) now aims for a renewable-energy target of 45%[2] (from previously targeting 40%). Moreover, the EU focuses on energy efficiency gains, since in Europe as in other continents, much of the energy being produced is wasted. In 2021, end-use consumption was about 70% of primary energy consumption, including all energy uses, implying an energy loss along the value chain of about 30%.[3] This suggests significant potential for efficiency gains in transportation, distribution, and the delivery of energy.

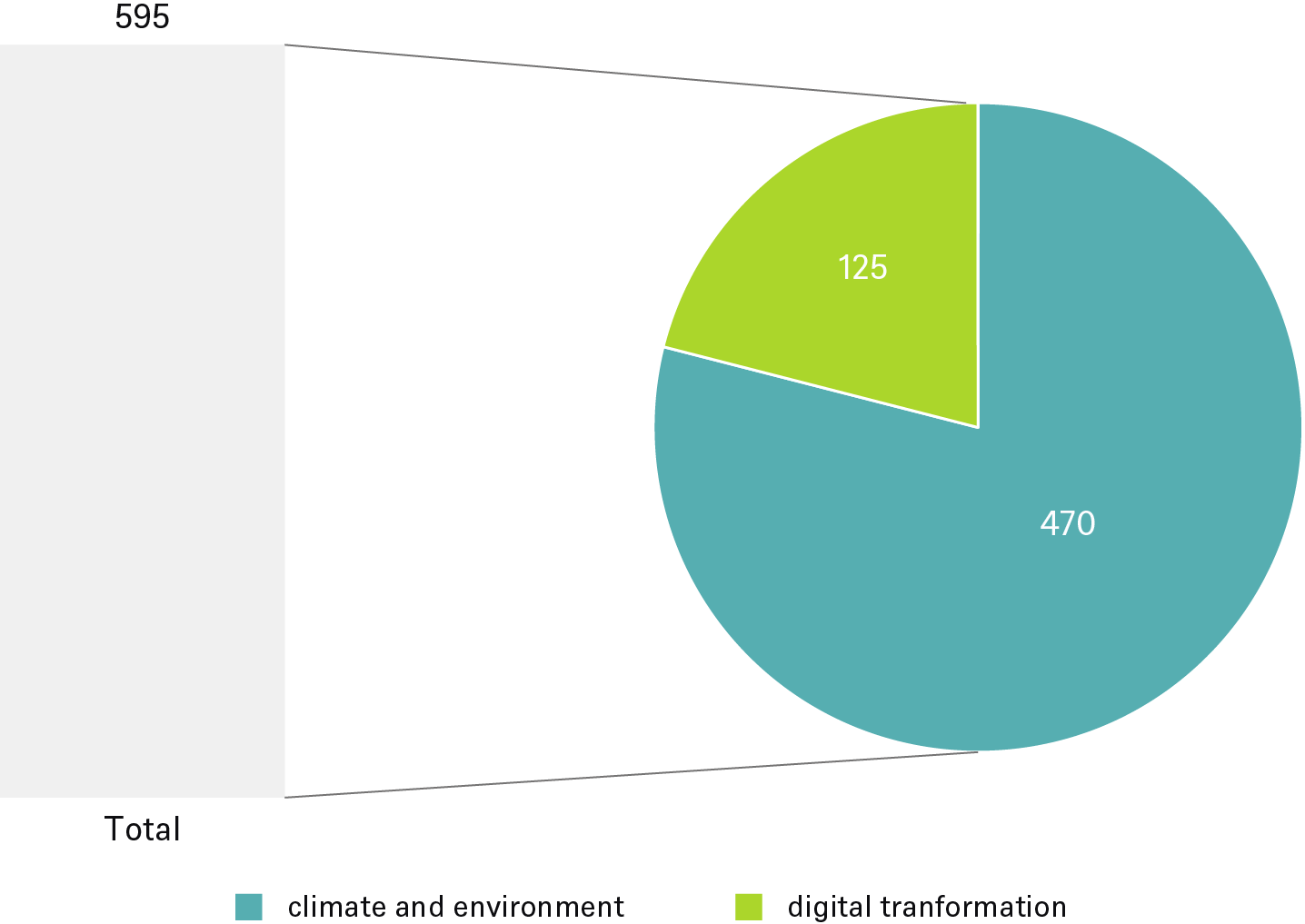

Europe: Investment gap in climate & digitalization

billion euros per year*

Source: European Commission Staff Working Document, “Identifying Europe's recovery needs and Climate” as of 5/27/20

The policy aims give a taste of the challenges and opportunities ahead, within the context of a rather nuanced outlook for global infrastructure (see theme 8).

Europeans are just about to seize their opportunity and invest together in change. We assume that the willingness will continue over the next few years. But not only their willpower puts us in a positive mood. In democratic societies, it can take crises as well as electoral events to remove blockages. By re-sharpening targets, the next months should provide good entry points to invest in digital and energy infrastructure assets. As the chart shows, private investments in critical infrastructure are needed alongside public money to close the gap of nearly 600 billion euros per year in Europe alone.

With the next European elections looming in 2024, time is short and changing political winds at the European level cannot be ruled out. Another open question is how the lofty goals will translate at the local level, once the sense of crisis passes; especially in federal countries, such as Germany. If Europeans can seize this opportunity, the gains could prove significant.

Digitization in the energy sector ideally means that energy flows can be analyzed and measured in real time, theoretically resulting in zero energy waste.

More decentralized energy economies can enable greater reliance on renewable energy. Innovative new(ish) technologies could also reinvigorate Europe’s export sector. From smart meters to record energy consumption and sensors that collect information about the state of the electricity transmission network, to hydrogen and digital enablers such as fiber optic networks and energy- and cost-efficient data centers, there are plenty of opportunities to carefully choose from.