- Home »

- Insights »

- Global CIO View »

- Equities »

- Generative AI – a new iPhone moment in tech?

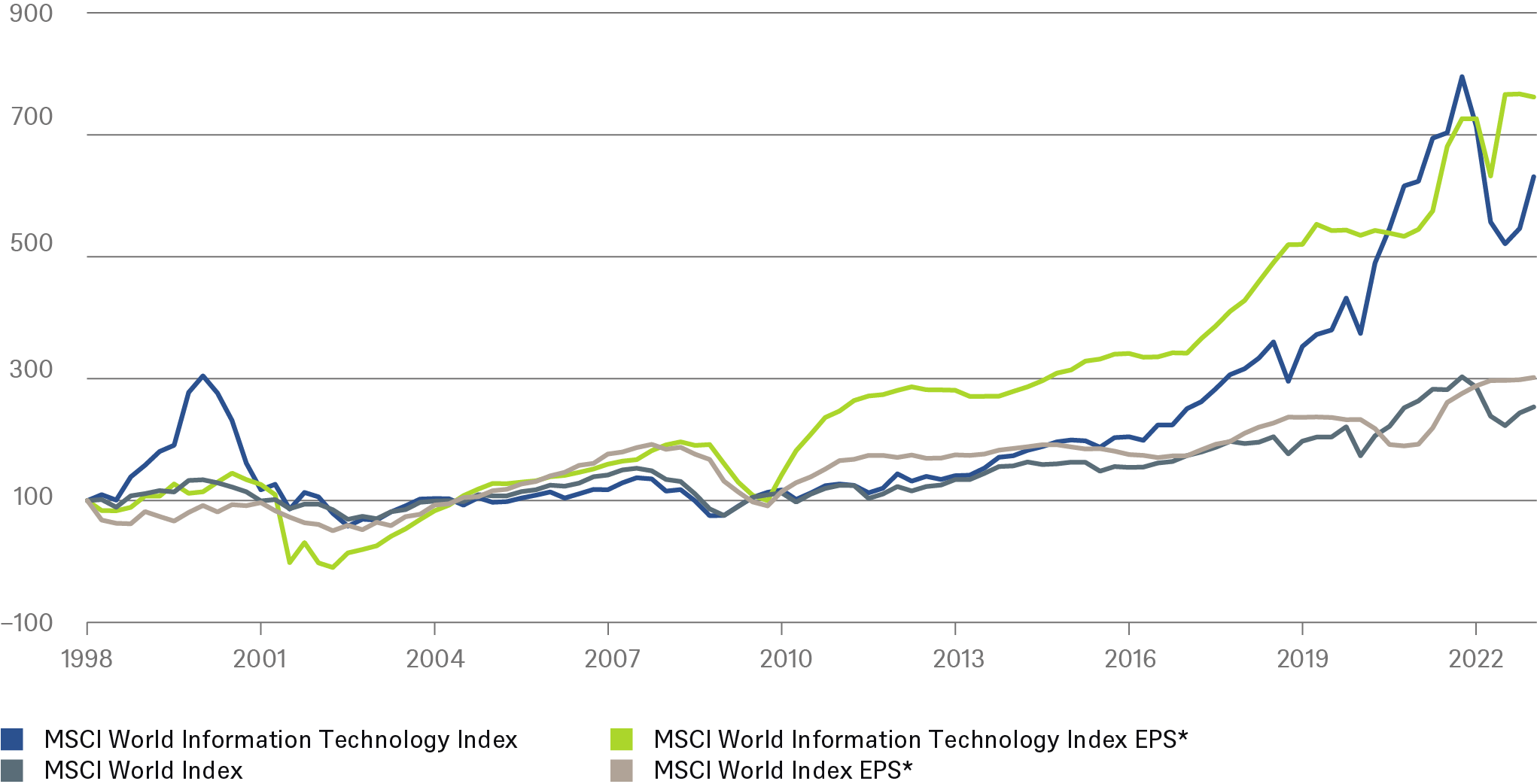

It has been a smooth ride for technology investors for decades. Even if you invested at the worst of all times in the Nasdaq Composite Index (March 2000), you would have averaged a 5% annual return by now. No surprise that investors felt vindicated when the information technology sector (IT) started to underperform in late 2021, mainly for three reasons: rising interest rates[1]; reduced IT demand post-Covid, and geopolitical tensions leading to tech-related sanctions. Admittedly, IT in 2022 has seen its worst correction vs. the market since the bursting of the dotcom bubble. But not least because of the sectors outperformance this year, IT trades again on a 40% premium to the markets[2]. But this has more to do with markets technicalities and savings programs than with exciting new growth segments.

The arrival of Generative Artificial Intelligence (GAI) has been touted as "a very big moment for the computer industry" by a leading technology CEO. GAI refers to a class of machine-learning models that are designed to capture patterns in the underlying data to be able to create (generate) new data that plausibly matches the original dataset – creative algorithms. When OpenAI launched their chatbot ChatGPT last November it took only five days to reach one million users – a record. Ever since then, numerous companies have announced that they are introducing similar chatbots. We might be experiencing a new iPhone moment in technology where GAI is democratizing data and enabling an abundance of commercial use cases. We are aware that many will call this hype[3] and warn of likely problems in the new technology, but we stick to our positive view.

IT sector vs. global equities

indexed: 6/30/98 = 100

Source: Bloomberg Finance L.P., DWS Investment GmbH as of 3/29/23

The availability of large datasets, the introduction of new techniques for training generative models and the rapid increase in computing power have speeded up the development of GAI massively. Fast Graphic Processing Units have enabled the training of models with billions of parameters in short time. We believe companies developing faster semiconductors or network connectivity are major beneficiaries of GAI’s growth.

GAI can do more than creating, summarizing, or translating text. Further potential applications include creating music, pictures, videos, and/or speech. GAI can be used to generate deep fakes; however, it can also help detect counterfeits (i.e., anomaly detection) and improve security through enhanced encryption services. Finally, software and chip companies can optimize their own coding/design process by using GAI.

We believe a wide variety of new applications and companies will emerge around GAI, driving rapid growth. In developed markets where economic growth is harder to find, companies with a structural growth profile will likely stay in demand. We believe the IT sector has the potential to keep on achieving above-average growth that equity investors cannot ignore. But not at all costs.