- Home »

- Insights »

- CIO View »

- CIO View Quarterly »

- Investing is a cinch

- All precise interest rate forecasts should always come with hefty disclaimers.

- Rather than just focusing on when exactly the Fed will cut interest rates two, three, or four times (of 25 basis points each), there is a case to be made for taking a broad range of plausible rate paths as a given and remaining nimble.

- We expect 2024 to be a good year for fixed income generally, and corporate bonds in particular.

“The attention paid to short-term forecasting, and the delusion of control which it offers, diverts both resources and debate away from more important matters,” the economist Paul Ormerod wrote in his 1990s classic “Butterfly Economics,” adding: “Less can be more.”[1]

With that in mind, we won’t bore you with too much detail in terms of the precise interest rate cutting path for coming months, not least as neither markets, nor central bankers themselves seem all that certain these days.[2] Doing so requires listing the precise short-term risk factors that might push each major central bank one way or the other at any given meeting, and if markets are currently uncertain, that’s generally because there are good arguments on both sides. For fixed income investors, what is instead key is the underlying, longer-term picture. On this, we see remarkably little change since our year-end outlook.

As we have long argued, inflation rates are coming down, but only gradually.[3] The disinflation process is slowing, and setbacks are likely along the way. We expect an average headline inflation rate of 2.8% year over year for the U.S. and 2.5% year over year for the Eurozone in 2024. Regarding growth, we keep our expectation for the Eurozone virtually unchanged at 0.7%, as monetary policy is working and inflation rates have come down. For the U.S., we have to adjust our growth path due to a robust carry-over from 2023 but hold on to a soft patch in the middle of 2024. We think that the U.S. economy will grow by 1.8% in 2024.

This might allow the European Central Bank (ECB) and the U.S. Federal Reserve (Fed) to start a gradual normalization process of policy rates by the mid-year. We see the Fed funds rate to be cut to 4.50% – 4.75% by March 2025, and the ECB deposit rate to 3%. We forecast that the Bank of Japan (BoJ) will probably hike the policy rate to +0.25% over the current 12 month forecasting horizon, until March 2025.

To be sure, all such forecasts –should always come with hefty disclaimers.[4] For example, the outcome of the U.S. election is likely to play a major role for financial markets and will determine where many asset classes will trade in one years’ time. The range of plausible outcomes is wider than usual, not least as both major parties’ nominees are unusually unpopular.[5] U.S. policymaking, moreover, will depend not just on which of the two elderly frontrunners – or someone else – wins the White House, nor even – arguably just as important and even trickier to forecast early on – how key Congressional races will play out. Instead, what any administration is likely to do will, as usual, critically depend on events leading up to election day and beyond.[6]

While we expect volatility to pick up in line with historical experience in the run up to the elections, many market projections are likely to be subject to revisions once a clearer picture emerges not just regarding the likely outcome, but how market participants interpret it. Quite often, political events are easier to forecast than investor reactions to surprises – just take the conventional wisdom in markets ahead of the 2016 U.S. presidential election.[7]

That said, we expect 2024 to be a good year for fixed income in general, and corporate bonds, as well as other spread priced fixed income assets, in particular. Despite all uncertainties, we remain convinced that central banks will cut policy rates – just not as quickly or as aggressively as some other market observers had assumed. For developed market sovereigns, such as Bunds and U.S.-Treasuries, we see the best risk-adjusted returns at the shorter to middle part of the maturity spectrum.

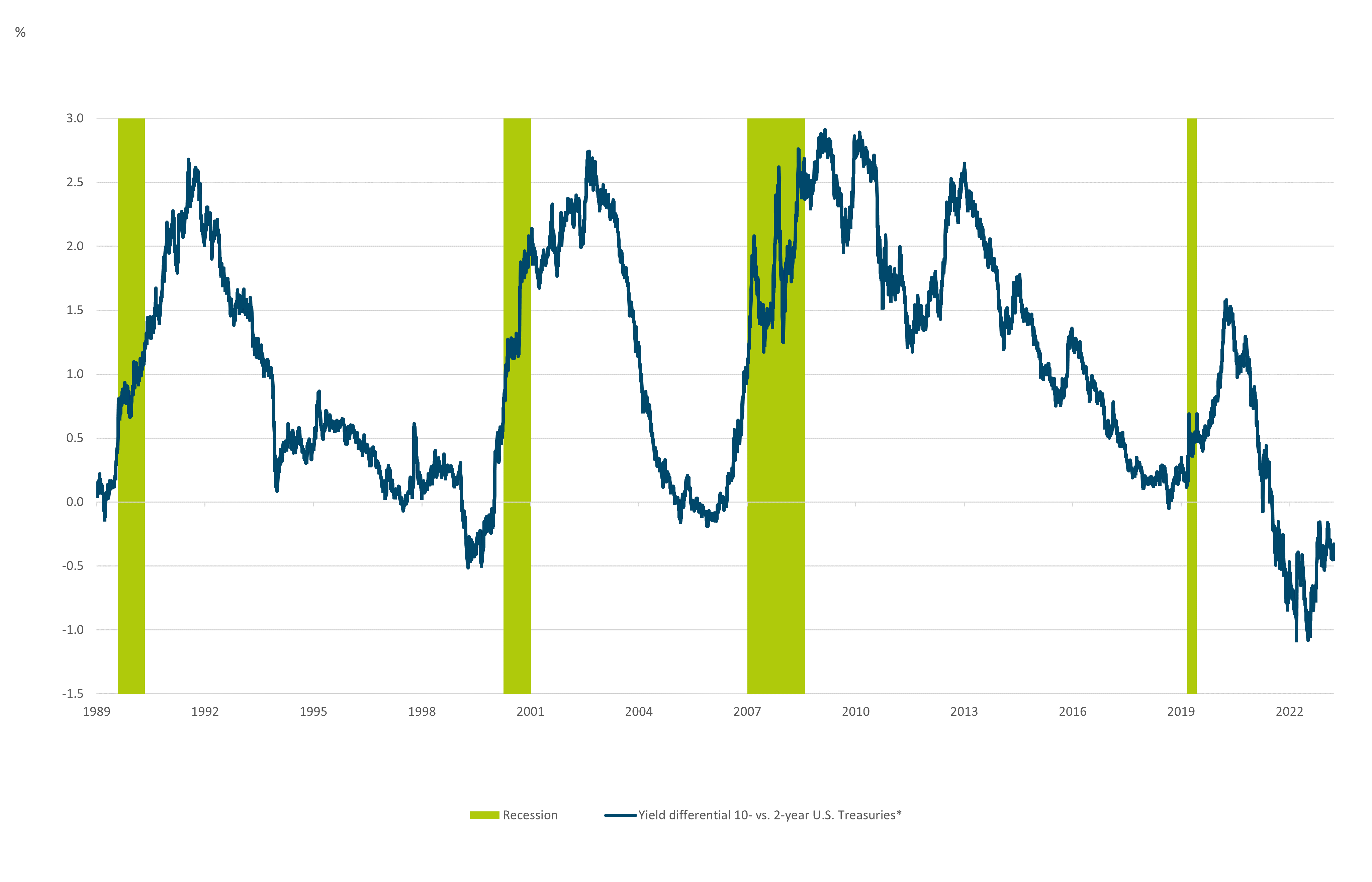

Note that currently, the yield curve is inverted as illustrated in the chart below using the yields on 10-year U.S.-Treasuries minus those on 2-year Treasuries. That means that for now, investors can earn higher interest by lending briefly or even just parking their money overnight rather than buying a longer-dated bond. Once rate cutting might start in the summer months, we expect current high money market fund balances to increasingly move into short duration sovereign debt. Falling inflation and moderating growth should thus be supportive for a steepening stemming from the front-end of the curve. We expect Bund yields to hit 2.5% and 2.6% in March 2025 for 2- and 10-years respectively. For the U.S. we expect 3.95% and 4.20% for 2- and 10-years respectively.

An inverted U.S. yield curve without a recession, at least so far

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 3/22/24

* yield resulting from 10-year minus 2-year U.S. Treasuries

Against this backdrop, we remain positive on Euro investment grade (IG) corporate bonds, where we expect to see further spread tightening to add to already high yield-to-maturity yields, also illustrated below. High quality covered bonds still look fine, even if the valuations are not that compelling following the recent swap spread tightening. Other investment opportunities we like include bonds with an ESG focus, such as common Next-Generation EU new issuance. Asset back securities should also benefit from short duration, inverted curve and strong credit performance. We expect emerging market (EM) sovereigns too to perform well, with spreads moving sideways. We generally favor euro-denominated IG rated EM bonds, over their U.S. dollar denominated higher risk peers, but caution that such investments need to be judged on a case-by-case basis.

Historically, yields look attractive, especially on U.S. investment grade bonds

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 3/22/24

1 The Bloomberg USD High-Yield Corporate Bond Index is a market-value-weighted index engineered to measure publicly issued non-investment grade USD fixed-rate, taxable and corporate bonds. Emerging market debt is excluded.

2 The Bloomberg Barclays U.S. Aggregate Credit Index measures the investment grade, U.S. dollar-denominated, fixed-rate, taxable corporate and government-related bond markets.

3 The Bloomberg Barclays Emerging Markets Sovereign USD Index measures the performance of USD-denominated government bonds from more than 60 emerging markets.

4 The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury, current duration: 7.8.

Selection remains critical for all spread priced fixed income assets. For example, both dollar and Euro high yield (HY) corporate bonds have benefited from the enthusiastic mood in recent months, boosting risky assets of all sorts. Given higher refinancing costs, this could leave some HY issuers vulnerable to setbacks, whenever sentiment deteriorates. Whether to consider wider HY spreads as buying opportunities, though, in part remains on corporate fundamentals – though these mostly remain strong, detailed attention is required in uncertain times issuer by issuer and bond by bond. On the plus side, it is worth keeping in mind that credit – unlike nominal sovereign bonds – can implicitly buffer some inflation, by boosting nominal revenues.

Which takes us full circular to the observation we started this piece with. “The economy at the aggregate level behaves much more like a purely random system than one that can be predicted and controlled,” as Omerod put it in one of his other books.[8] Take the seemingly common-sense idea that wage growth is necessarily inflationary and thus worrisome for central banks. Not necessarily, as we recently argued for the U.S., if it turned out to reflect lowly paid, young job switchers moving into potentially more productive jobs.[9] Sometimes, potentially worrying developments such as continuing wage growth can instead hint at benign structural changes, upon closer inspection.

The fact remains that markets, investors and, yes, even central bankers, have a dismal record when making forecasts at the best of times, let alone the unusual ones we have been through in recent years. Rather than just focusing on whether and when exactly the Fed will cut interest rates two, three, or four times (of 25 basis points each), there is a case to be made for taking a broad range of plausible interest rate paths as given. Such an approach enables nimble investors to be ready to position themselves to secure decent returns against a wide range of these. “There is ample scope for strategy to fail at any point in time.”[10] For this very reason, we are quite confident that markets will throw up interesting opportunities in the months to come.