Accelerating is calculated using sequential year-over-year percentage changes in inflation based on CPI.

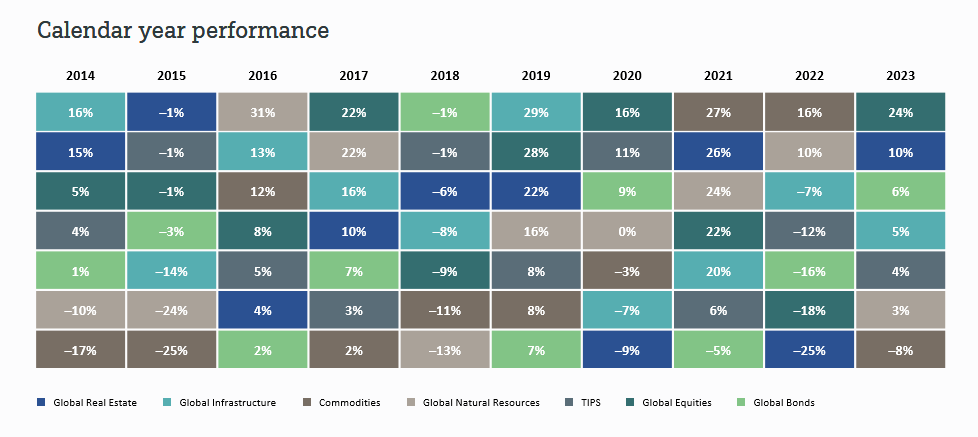

**Global infrastructure returns shown from 9/30/08 to 12/31/23 due to index inception date. All other returns shown from 12/31/02 to 12/31/23. Sources: Bloomberg and DWS. Past performance is not a guarantee of future results. Asset class representation: global infrastructure, Dow Jones Brookfield Global Infrastructure Index; global real estate, FTSE EPRA/NAREIT Developed Index; commodities, Bloomberg Commodity Index; commodity equities, S&P Global Natural Resources Index; TIPS, Bloomberg U.S. TIPS Index; global equities, MSCI World Index; global bonds, Bloomberg Global Aggregate Index. Equity index returns include reinvestment of all distributions. Index returns do not reflect fees or expenses, and it is not possible to invest directly in an index.