More than just three letters, ESG will change our world

How sustainably does a company or even a state operate? ESG criteria, which have become established as standard in the financial sector and the corporate world, help to answer this question. ESG is the abbreviation for “environmental, social and governance” – a term that encompasses environmental considerations, social affairs and corporate management.Growing regulatory pressure worldwide

Sustainability is not only increasingly important to our everyday lives. It is also rapidly rising up the policymaking agenda, informing fiscal decisions at national and international levels. The European Commission's Sustainable Finance Action Plan is a prime example of a growing determination to integrate ESG criteria into the financial system. In order for the European Union to become climate-neutral by 2050, billions will have to be invested. The EU Sustainable Finance Action Plan supports the European Union's efforts to meet the ambitious climate and energy commitments adopted in Paris. These include reducing greenhouse gas emissions and doubling the share of renewable energies in final energy consumption. In addition, the European Commission also seeks to channel capital flows into areas that promote the United Nations' Sustainable Development Goals (SDGs). Asset managers such as DWS are crucial in shaping capital flows towards sustainable investments

Responsible Investing has a positive impact

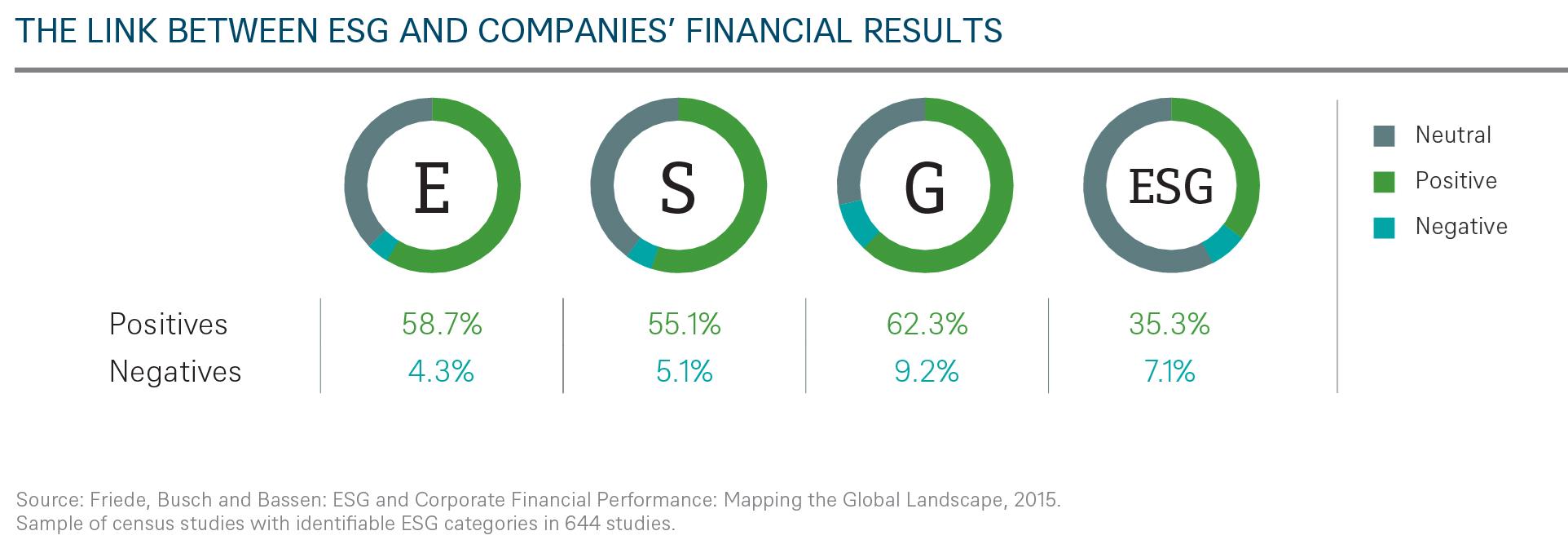

A meta-study on ESG conducted by DWS and the University of Hamburg has become a cornerstone of the case for responsible investing. The authors of “ESG and Corporate Financial Performance: Mapping the Global Landscape“ examined more than 2,200 empirical studies written since the 1970s until 2015 and concluded that there is “overwhelming evidence of the economic viability of ESG investments” and that considering ESG criteria need not impact on performance.

The positive relationship between ESG and performance was found to be especially strong for equities, fixed-income

securities and real estate. From a regional perspective, the studies also showed that ESG effects were particularly

relevant for performance in North America and also in emerging markets.