- The trend towards increasing deglobalization has gained momentum in recent years, with the prime example the trade war between the U.S. and China.

- Protectionist tendencies are also likely to persist after the U.S. elections, regardless of the outcome.

- Technologies that are considered critical are being specifically promoted, particularly in the U.S, offering opportunities for investors.

A globalized world no longer seems to be what the U.S., China or even the Eurozone are striving for. In fact, the opposite trend has become increasingly apparent in recent years. Deglobalization is taking place through trade wars and conscious efforts to reduce mutual dependencies. Countries’ protectionist measures are focusing on promoting their own strengths. Under the label of national security, the U.S. has identified 14 (see table on page 5) that are seen as particularly worthy of support. This offers some interesting prospects for investors.

1 / Deglobalization or merely de-risking?

Is global trade part of the solution or part of the problem? Ralph Ossa, Chief Economist of the World Trade Organization (WTO), posed this question at the beginning of the year.[1] Have we passed the peak for globalization? Are we in fact dismantling globalization? Ossa sees a danger that "the flattening of globalization is turning into deglobalization." Other observers, too, see worrying protectionist tendencies.

We expect approaches to trade, national security and promoting domestic economies to play an important role in the upcoming elections around the world this year. In the U.S., the question of the attitude towards important trading partners is already the subject of much debate in the run-up to the presidential election. Donald Trump has already positioned himself very clearly, particularly in relation to China, with threats of higher tariffs.[2] During his time in office, Joe Biden has also already taken measures to weaken China's position in relation to the U.S.[3] Both politicians are focused on strengthening domestic industries and safeguarding national interests. However, it seems as if they are willing to accept damage to China’s strengths.

In Europe, too, there are already pronounced tendencies to become more independent in important areas. One project promoted by the European Commission is the Strategic Technologies for Europe Platform (STEP). STEP aims to support investment in critical technologies in the areas of digital technology and deep tech, which aims at finding innovative ways to solve fundamental problems. STEP also focuses on environmentally friendly technologies and biotechnology. According to the Commission, the aim is to reduce the European Union's (EU’s) strategic dependencies and strengthen its long-term competitiveness. STEP mobilizes financial resources from various EU programs and directs them primarily towards digital and green technologies. In total, . To increase this investment capacity even further, a separate budget of EUR 10 billion is planned for STEP. [4]

Despite focusing on building its own strengths, the EU is nevertheless endeavoring to employ a moderate tone, particularly towards China. "Our strategy vis-a-vis China in this context is not a decoupling strategy, but a de-risking strategy," said French President Emmanuel Macron, for example, referring to measures to restructure global supply chains, which often center on China.[5] Macron went on to say that the de-risking strategy was "totally accepted by China" and was a "fair" way of working together that would prevent the EU from being "too dependent on some critical part of our value chain."

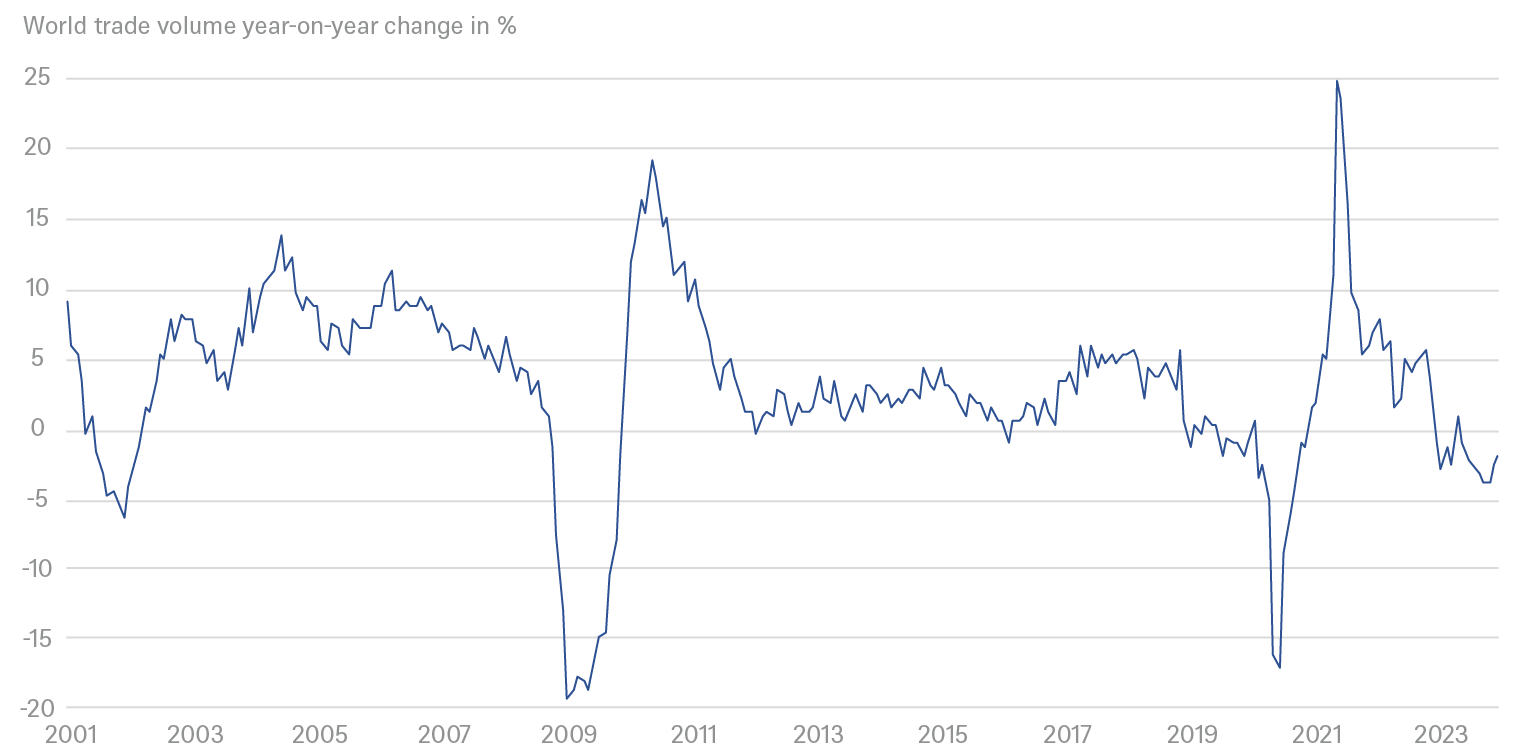

Global trade flows decrease noticeably

Sources: CPB Netherlands Bureau for Economic Policy Analysis, DWS Investment GmbH as of 11/1/23

1.1 Global companies under pressure to adapt

The trend toward deglobalization presents companies with a wide range of challenges – and opportunities. The impact on them varies greatly depending on their level of international exposure and geographic presence in general. Nevertheless, in the current environment, it seems essential for most companies to take at least some steps to be strategically prepared for the geopolitical changes that have occurred or are coming. The strategic decisions that are needed should be deeply integrated into companies’ business models and strategies as they are likely to be critical for some time to come. Companies that position themselves early could gain an advantage.

The key issues are increasing the resilience of global supply chains and adapting sustainability criteria to the new geopolitical realities, as Ernst & Young (EY) highlighted in its geostrategic outlook for 2024.[6]

Companies should, for example, realign their global presence and corporate strategy to a more complex, multipolar geopolitical landscape, rethinking supply-chain strategies, and potentially expanding production capacities and supplier relationships in new markets and in the competition for raw materials. The risks posed by the current geopolitical shifts are many and varied.

2 / Tense relationship between the U.S. and China

The power games taking place between the U.S. and China show how the global struggle for influence and supremacy is evolving. Neither side is stepping back; attempts are being made to gain advantage in all areas.

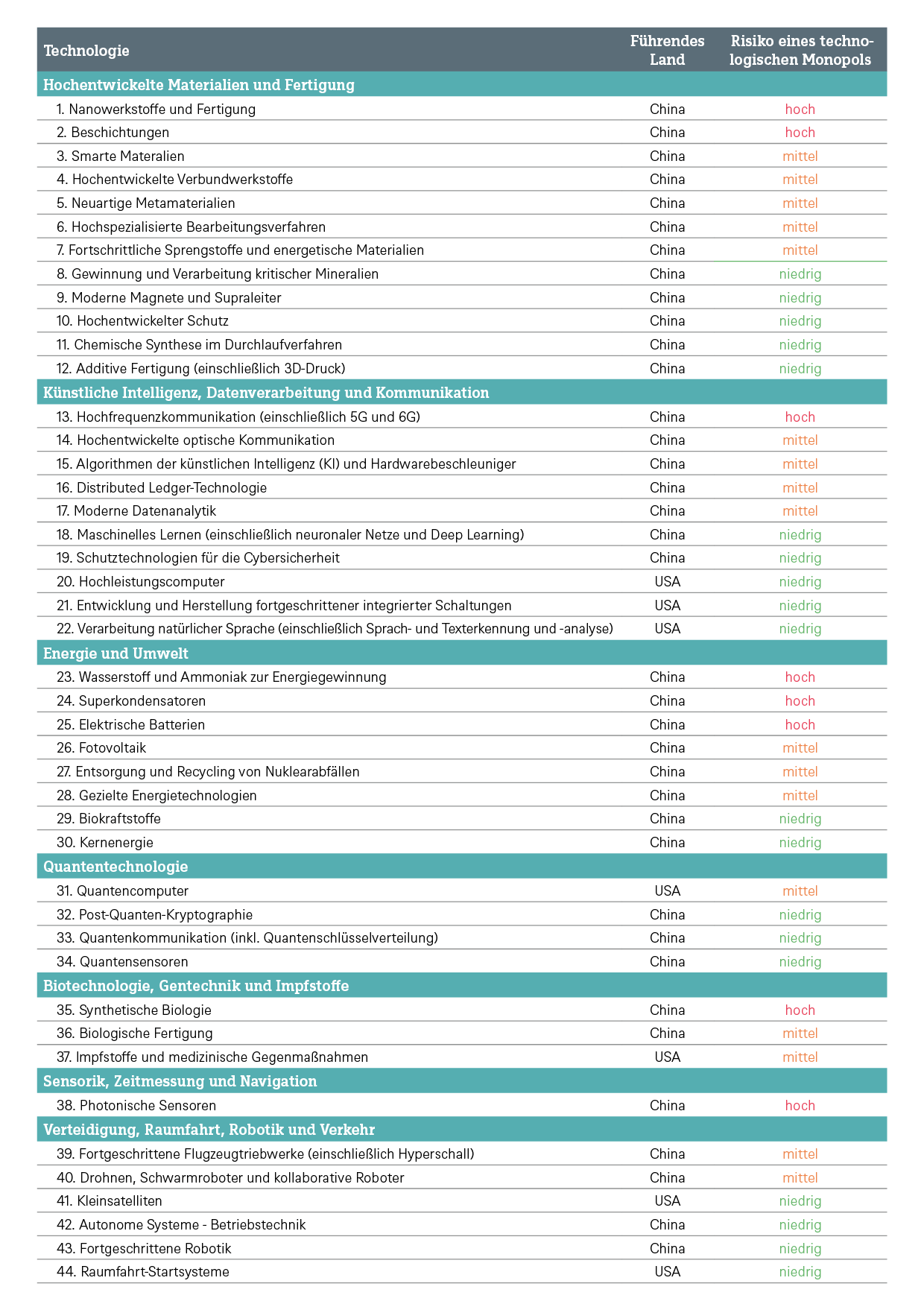

The protectionist race between the U.S. and China is most intense in technology. Over the past few years, under President Joe Biden, we have seen a shift from the trade war initiated by Donald Trump to a tendency towards demarcation, particularly regarding technological advances and investments. On the American side it is understandable that there are concerns that the United States no longer enjoys a pioneering role in the technology sector. According to a study by the Australian think tank ASPI, China was the leader in 37 out of 44 critical technologies in 2023 (see table [7] ASPI sees China in the lead particularly in the areas of high-tech materials and industrial production, energy, the environment and artificial intelligence. The U.S., meanwhile, is ahead in the fields of high-performance computing and quantum computing, in ASPI’s view.

The U.S. has been aware of losing ground for some time and the Biden administration has already reacted with many hundreds of billions of dollars in subsidies and incentive packages for business and science. One example is the CHIPS and Science Act under which over 200 billion U.S. dollars are to be invested to strengthen the semiconductor industry and promote research. The Inflation Reduction Act also offers multi-billion-dollar subsidies, in this case to support clean energy. The aim is, through targeted support, to return domestic sectors to a position where they can regain international leadership.

In our view, no noticeable changes to U.S. trade policy are likely after the U.S. elections in November. Joe Biden and Donald Trump do not really differ greatly in their international orientation – as the past eight years under two different administrations have shown. Thus, their behavior towards China is likely to remain confrontational beyond November, though they may sound particularly tough in the run-up to the election. Their position will probably be more nuanced afterwards. We expect them to be willing to talk to the Chinese leadership and to avoid closing all doors to cooperation. Fundamentally, however, a protectionist course is likely to remain dominant.

As important elections are taking place in many countries this year, the protectionist tendency risks being reinforced globally. The proliferation of economic demarcation lines has dealt a significant setback to globalization and free markets. The frequently cited security argument is undermining the multilateral trading system and the principles of fair trade and impairing cross-border transactions. Because that is what it is all about: security. The U.S. Department of Defense (DoD) plays an important role in determining which areas require particular attention and which topics need special support. The Department, in the form of the Under Secretary of Defense for Research and Engineering (OUSD(R&E)), states that it works "closely with the Military Services, Combatant Commands, industry, academia, and other stakeholders to ensure that the Department's science and technology strategy addresses the key national security challenges – from rising seas to a rising China – that the United States faces today and will face in the future."[8]

China's competitive advantages over the U.S. as identified by the ASPI

Source: Australian Strategic Policy Institute, DWS Investment GmbH as of 9/22/23

3 / Special support for critical tech in the U.S.

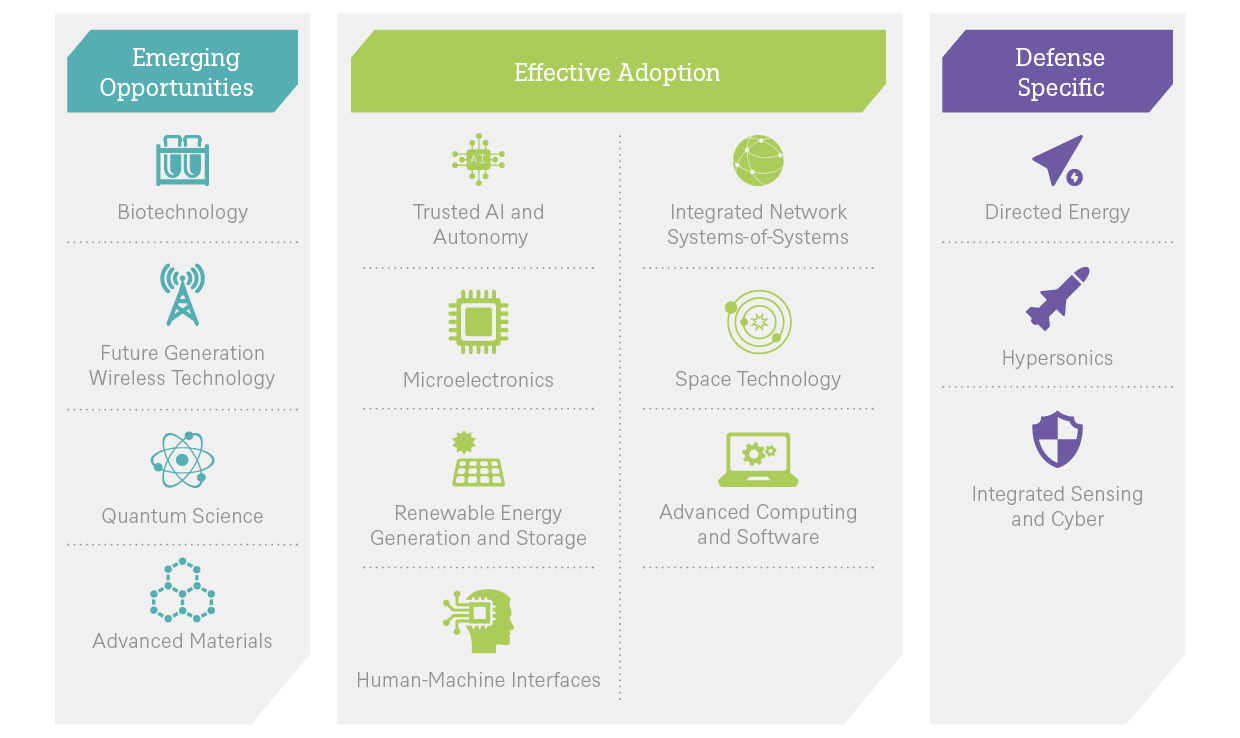

The U.S. Department of Defense (DoD) divides the technology areas it sees as critical into three categories: Emerging Opportunities, Effective Adaptation and Defense Specific. Within these segments, it identifies 14 technology areas it considers vital to maintaining the national security of the United States.[9] By focusing efforts and investments in these 14 critical technology areas the Department believes that "transitioning key capabilities to the Military Services and Combatant Commands" can be accelerated. The categorization is by no means set in stone; the DoD reserves the right to update the prioritization list as necessary. A handful of these critical tech areas, such as hypersonic systems and so-called directed energy weapons – which includes high-energy lasers and microwaves – are almost exclusively relevant to the military. Most, however, are being developed by the private sector for the broader market.

Naturally, the financing of research and innovation is important in this context. Private-sector capital is the dominant source of funding for technology development, and the Defense Ministry has set up its own investment arm to provide assistance.[10] According to the Department, this will enable it to "build enduring advantages though engagement with trusted private capital that is focused on critical technology areas for the Department of Defense."

The explicit support for critical technologies is likely to be of great interest to investors. This is particularly true if it is assumed that targeted support can stimulate innovation and thus also growth.

The 14 critical technologies as identified by the U.S. Department of Defense

Source: U.S. Department of Defense, DWS Investment GmbH as of 2/14/24

4 / Summary and outlook

The reversal (or at least partial reversal) of globalization efforts is a trend that is likely to continue in the foreseeable future. The past few years have taught us that though close international integration brings advantages it can also have a negative impact on a country's own ability to act, particularly in times of crisis. It is quite understandable that countries want to protect themselves against this, even if some protectionist measures seem to overshoot the mark. International cooperation in a wide range of areas will nevertheless remain a necessity. "Lone-wolf" tendencies could set the world back years – including in national security.

The current trend towards deglobalization does, however, offer investment opportunities. Companies from critical technology sec-tors are likely to have good prospects for special funding, particularly in the U.S. Regardless of which presidential candidate prevails in November, the United States likely will continue to pursue a strategy of becoming more independent again in the technology sector and, above all, restoring the supremacy it has lost to China. The 14 technology categories identified by the DoD are expected to receive large investments. And the tech sector in general likely will continue to be the central focus of the markets as the innova-tion and drive for disruptive change through increasing digitalization press ahead. Companies that can expect special support be-cause they belong to one of the 14 critical technology areas could even benefit more.