As the U.S. Federal Reserve (Fed) continues to wrestle with getting inflation fully under control, the effects of the recent and horrible attack on Israel by Hamas will further complicate an already uneasy macro backdrop. With the economic surprise index still elevated, the most recent Nonfarm Payroll report showed that the U.S. added 336,000 jobs in September. It was a very surprising number from the market’s expectations with upward revisions totaling 119,000 to the July and August reports, showing the labor market appears robust. All of this gave rise to headlines like “troubling news for the Fed” and worries of another rate hike. It is true that average payroll growth has been solid over the summer with 266,000 jobs added but is still less than the 300,000-plus jobs added earlier in the year, while monthly gains a year ago averaged 423,000.

At a time when markets want clarity, this jobs report only perplexed. Will there be a soft or a hard landing? Are we tiring of an anticipated recession that doesn’t want to appear or are we simply not listening to the information a data-dependent market is giving us?

Let’s focus on what we know

Labor market

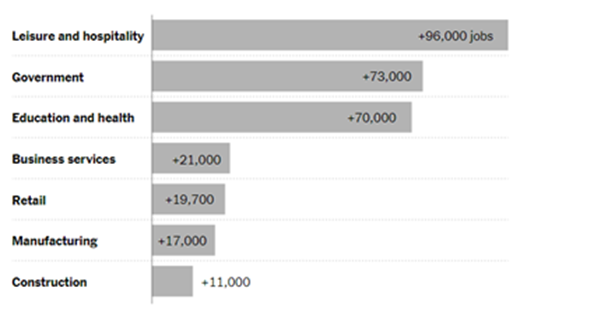

Leisure and hospitality, led the job gains with 96,000, recovering from huge pandemic-related job losses; Government added 73,000; Education and healthcare added 70,000 jobs bolstered, in part, by the return of teachers.

Change in jobs in September 2023, by sector

Source: U.S. Bureau of Labor, as of October 6, 2023

Bond markets

Yields on the long end moved the most reacting quickly with the 30-year Treasury rising 10 basis points (bps), breaching 5% before easing. The 10-year rose 0.07 percentage points settling on 4.78, after it touched a 16-year high of 4.88% earlier in the day.

The U.S. Yield Curve

Source: Fact Set, as of October 20, 2023

Underlying facts

While September’s jobs number is an impressive data point, the underlying facts are somewhat less impressive. The unemployment rate held steady with 3.8% with labor force participation rate unchanged. Wage growth continued to slow with average hourly earnings increasing just 0.2 percent, which is what the Fed will be watching in order to return to their 2 percent target. The average number of hours worked has remained essentially flat to pre-pandemic levels.

Year-over-year percentage change in earnings vs. inflation

Source: U.S. Bureau of Labor, as of October 6, 2023

Hamas attacks on Israel

With the carefully crafted and catastrophic attacks rendered over the weekend against the people of Israel, markets moved quickly with downward pressure on yields. We saw a flight to quality with a spike in gold and the 10yr quickly moved down to 4.60%. Travel and leisure sold off with crude oil and aerospace gaining. Geopolitically, all eyes are watching Israel anticipating if their response might widen to include other enemies in the region, particularly Iran. China, in particular, is acutely monitoring the dynamics in the region as they have been more pronounced players in Middle East politics and have been buyers of Iranian oil. The matter is further complicated as China has great respect for the people of Israel and its history.

Consumer Price Index

September core Consumer Price Index (CPI) rose 0.32%, a four-month high, but close to consensus expectations for a 0.3% increase, and the year-on-year rate fell by 0.2pp to 4.1%. A sharp increase in hotel prices contributed 5bp to the core, the more persistent rent, operating expense ratio (OER), and healthcare categories were stronger than the market expected. The bottom line is that a strong labor market is underpinning consumer demand and keeping price pressures higher than the Fed’s target. As a result, some market players are pricing in higher odds of another Fed rate hike.

With this backdrop, will the Fed raise rates?

Part of the conundrum depends on whether the Fed views jobs resilience as a positive series of events, rather than troubling. In a vacuum, a hot Jobs number, plus CPI and core producer price index (PPI) would meet the bar for another rate hike, but I’m not convinced it’s enough. With the large move higher in long end yields, financial conditions have already tightened consistent with a 25bps hike since the September meeting.

And a lot has changed since the job’s number. Israel declared war, the House isn’t close to electing a new Speaker and another Government shutdown is on the horizon. Treasury supply has continued to jam the market – and with 3 auctions that were poorly received. While the Fed’s September meeting minutes showed a bias to keep policy restrictive into 2024, it also expressed a need to balance the risks of overtightening against keeping inflation on a downward trajectory. This means that while the November meeting seems to a be a “continued pause,” December’s meeting is now live.

Until then, Stay Focused!

– George