- Home »

- Insights »

- Fixed Income »

- European high yield – enough meat on the bones

An annual loss of "only" 11.6%. That doesn't exactly sound like a good argument for an asset class. But it all depends on the context. Because with this result, European high-yield (HY) bonds[1]still performed significantly better than most other bond segments last year – the best house in a bad neighborhood so to say. Especially government bonds took a beating. Most European 10-year bonds lost 20% or more, while 30-year German Bunds lost almost half their value. This brings us to one of the reasons for the relatively good performance of high-yield bonds: their short duration of effectively 3.2 years.[2] The price loss in the event of interest-rate hikes is correspondingly lower (this cannot be ruled out for the current year either, even if it is not our base scenario).

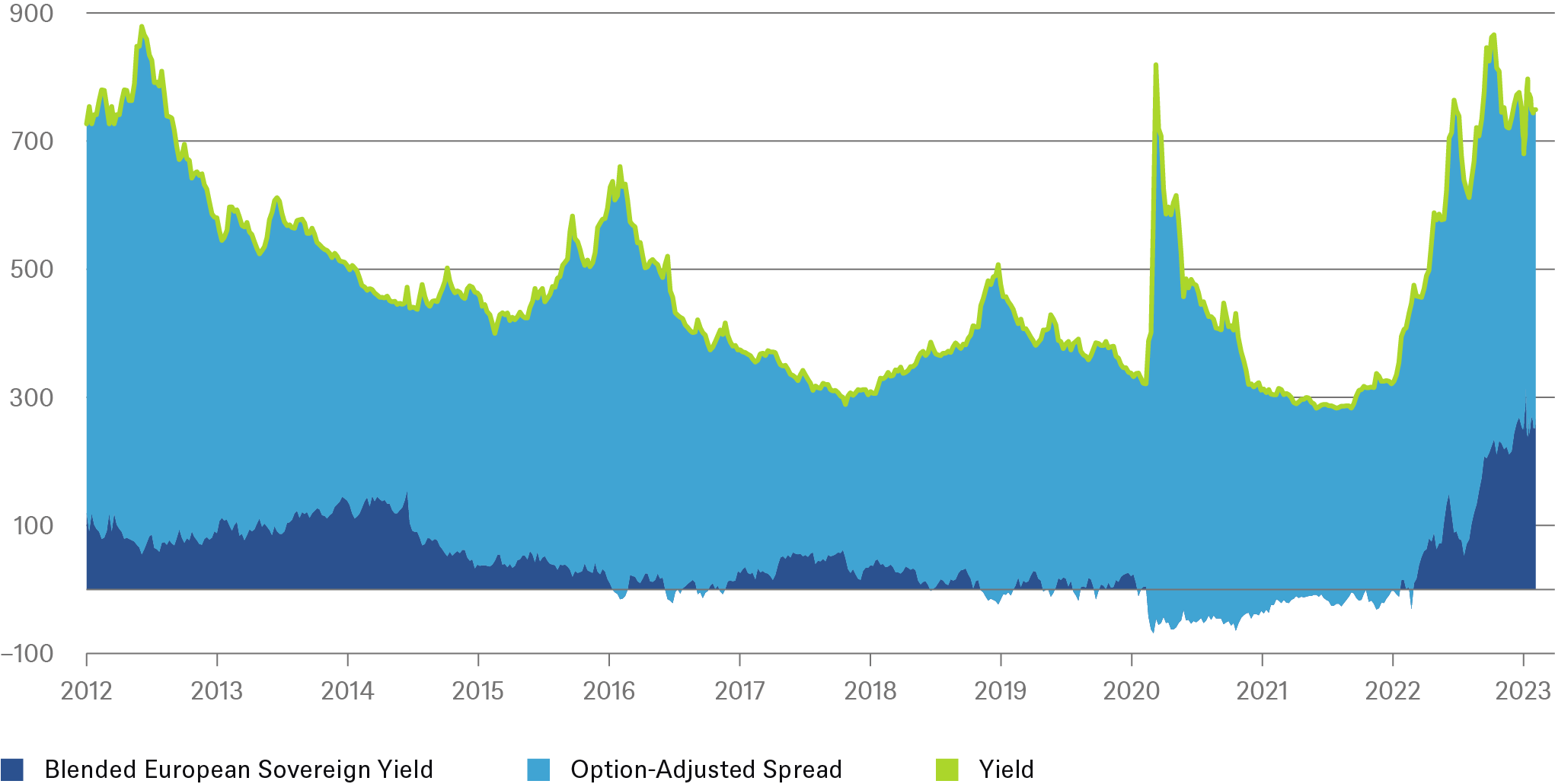

Of course, 2022 was anything but a good year for high-yield bonds, especially in the first six months. That's when bond prices suffered from both rising sovereign-bond yields and a rising risk premium (spread). The latter peaked in early July before collapsing back to levels seen at the beginning of the war. While this does not imply a further spread tightening over the course of 2023 – with a corresponding positive price effect – we do not expect much more here. On the contrary, we expect higher volatility leading to a renewed possible spread widening. As we have already experienced since the beginning of March in the course of the banking crisis.

European high-yield bonds

basis points

Source: Bloomberg Finance L.P., DWS Investment GmbH as of 4/11/23

However, this does not detract from the attractiveness of the asset class. After all, the effective yield of over 7% speaks for itself in our opinion. Especially when you consider the following points that support European HY as well:

—Default rates have so far remained very much within tight bounds.[3] Further, in the medium term we do not expect them to rise to a usual level for a recession. For two reasons:

—The feared winter recession did not happen, and it appears that energy supplies for the coming winter are secured. We also no longer expect a recession for 2023. However, the soft downturn is also likely to be followed by only a mild upswing, which is not a bad environment for high-yield issuers.

—Especially if they enter the downturn with positive remaining balance-sheet ratios, [4]particularly as they have borrowed (this secured funding) generously over the past two years.

In other words, we think a current yield of over 7% provides a decent risk buffer, whether against credit defaults or further increasing interest yields. We currently prefer the European market to the U.S. market as it has: a higher average credit rating[5](including a smaller share of energy and biotech stocks), higher spreads, a more inefficient market with a broader yield spectrum. In addition, the supply-demand environment in Europe currently seems more attractive.

The banking crisis in March set back the high-yield segment, as investors are alarmed by the lack of trade liquidity on such turbulent days. Moreover, they perceive a higher risk of recession including defaults. However, this is not our core scenario.