- Home »

- Insights »

- CIO View »

- Alternatives »

- Real estate – time to enter?

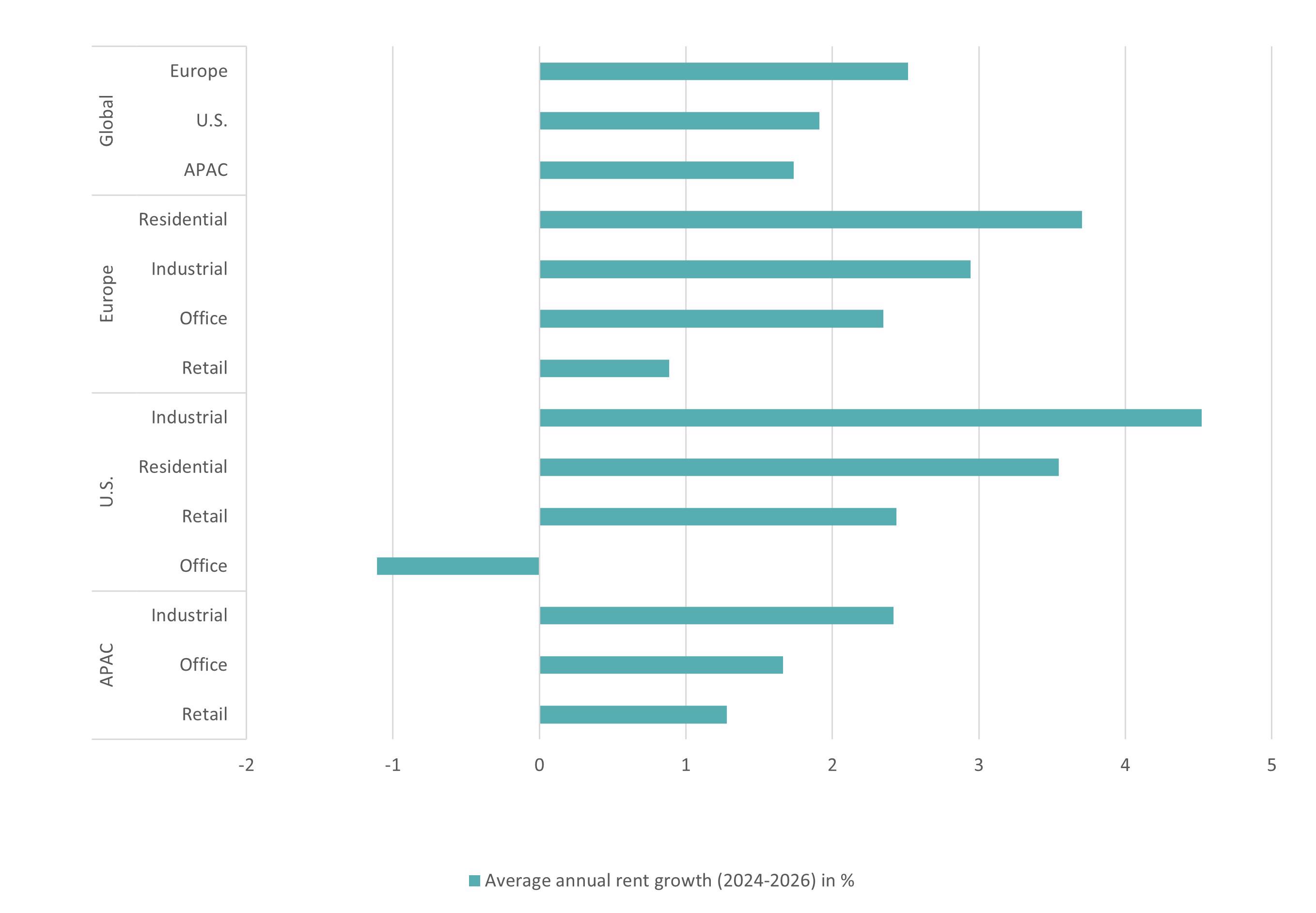

Expected rent growth by region and sector

Source: RREEF Management L.L.C. as of August 2023

As real-estate prices now largely reflect higher interest rates, there may be scope for upside if and when yields fall. “Fortune may favor the brave investor who can look through the dip, capitalize on attractive valuations and ride the next cycle,” argues Kevin White, Co-Head for Global Real Estate Research.

Timing, though, is tricky. As real-estate cycles turn, this can change how thick or thin markets are at different times, in ways that are similar to buying a good, a sandwich, say, in different places. In the economic jargon, mid-town Manhattan is a thick market for grabbing a lunchtime sandwich, giving a New York deli plenty of the cost advantages due to, say, workers being busy at all times, compared to, say, a similar eatery in small-town Iowa.[1]

Going from boom to bust is a bit like suddenly finding yourself in small-town Iowa in search of your favorite lunchtime sandwich. During a downturn, real-estate markets suddenly become thin. Typically, transactions get pulled, specialized suppliers – of financing, in particular – get jittery and no one can quite know precisely when potential buyers will shift from being cautious to fearing they may already have missed the best entry points for the best assets.

The ideas behind thin markets versus thick markets is that it is often more efficient for economic activity to be concentrated in either time or in space. An economic upswing and a city are essentially similar phenomena; their longevity depends on how long the agglomeration effects underpinning them are likely to last. This can be quite helpful in figuring out where such assets can be found. Take data centers. In many parts of the U.S., provisioning the required power from local electric utilities – rather than scarcity of developable land – has become the main limiting factor.[2] Eventually, power production and electricity grids will adjust. By that point, however, innovative clusters may already have emerged, giving rise to additional agglomeration effects.[3]