- Home »

- Insights »

- Alternatives »

- Global infrastructure assets – a more nuanced outlook

Infrastructure has delivered another outstanding year in 2022. Its longer-term appeal in inflationary times remains intact.[1]. The short-term outlook is more nuanced. Economic growth forecasts currently point to relatively shallow recessions in most markets. Infrastructure assets exposed to consumer demand are likely to face some pressure. For example, electricity producers that have no long-term supply contracts but feed directly into the spot market or short-term day-ahead market have done well over the last year thanks almost exclusively to unprecedentedly high-power prices. Conversely, an economic downturn in 2023 would probably hit these assets among the hardest.

However, traditional core assets, which tend to focus on mature assets providing yield, but limited capital appreciation potential, as well as so called "core plus" assets, without volume risk, are likely to see more resilient performance[2]. Still, a careful asset by asset analysis is required, with affordability concerns likely to be at the top of the agenda for many regulators. That might limit regulated assets’ ability to react to economic conditions. Contracted businesses that have inflation-passthrough and the ability to adjust terms - more than a regulated utility, for example – are likely to outperform in the current environment.

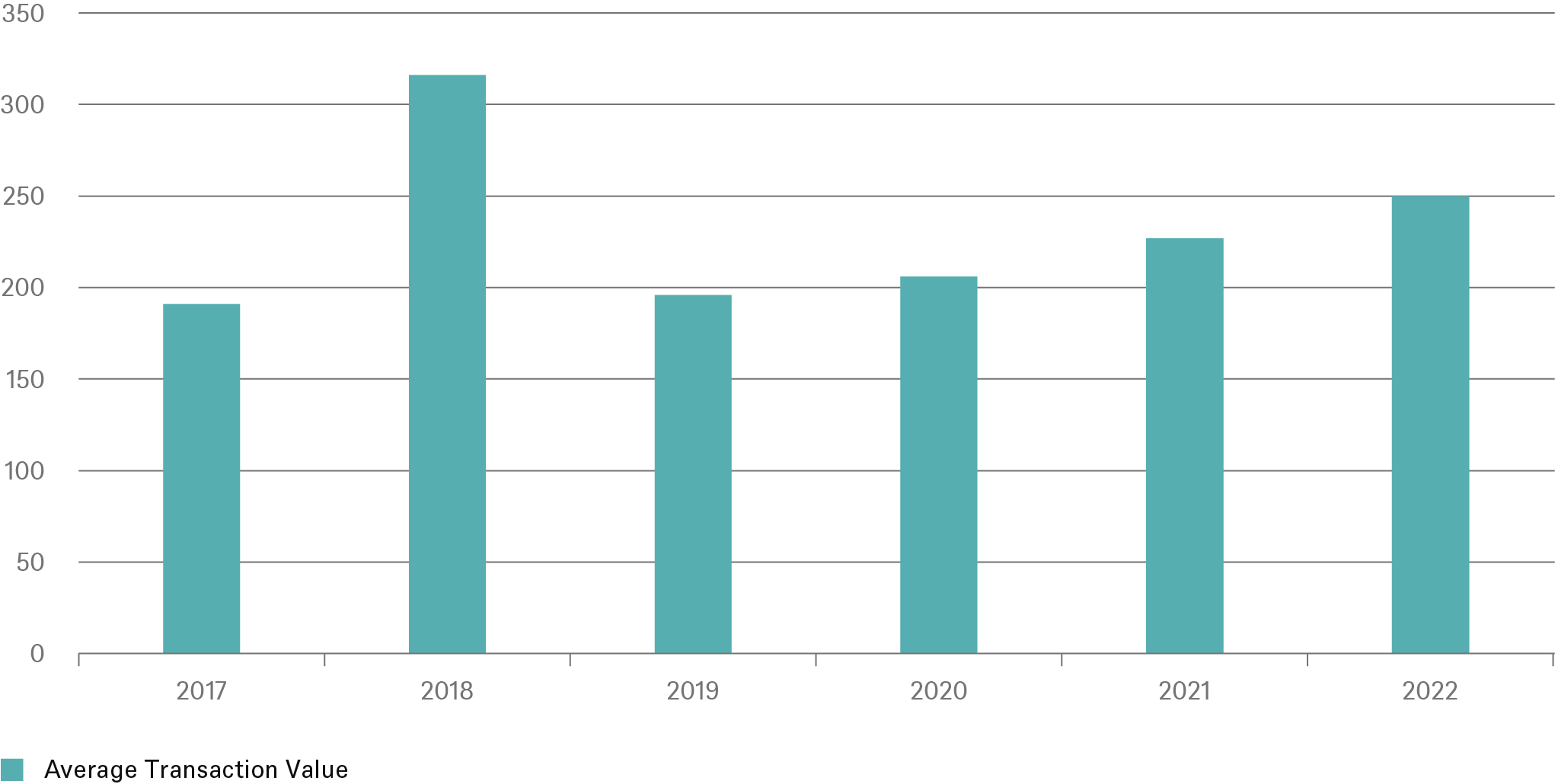

No signs of excess in terms of deal sizes

million euros

Source: Estimate based on DWS's own database*, as of 12/1/2022

With interest rates having risen and set to remain higher than they have been for many years, the impact on discount rates and infrastructure valuations will be increasingly felt across the market. The impact will partly depend on how quickly an asset has been able to adjust revenue streams to boost cash flows. In the more rigid core market, this may see valuations decline relative to core plus assets, which often have greater flexibility to adjust revenue streams and renegotiate contracts. Likewise, assets where valuations were normalized to reflect the anomalous nature of the persistent low-rate environment should see their valuations hold up relative to those assets which may have benefitted from low discount rates in recent years.

While headline inflation has probably peaked in most markets over late 2022, underlying inflation is likely to remain sticky, posing earnings risks for infrastructure assets less able to adapt. Key areas to watch remain the elevated capital and material input costs. Assets will see continued material cost pressures with metal prices, energy prices and, in particular labor costs, remaining elevated, even if the pace of cost increases slows.

Finally, we may see significant policy support on offer to infrastructure investors to speed up the energy transition. However, it is not clear yet whether many of the technologies deemed crucial to transition success will provide attractive returns to infrastructure investors. Examples include green hydrogen and charging infrastructure, where only limited business streams currently suit infrastructure investors. In short, selection and thorough bottom-up research remain as crucial in the coming 12 months as they have been in 2022.