- Home »

- Insights »

- DWS Research Institute »

- Multi-Asset Longview

- A new DWS study examines the most important asset classes’ long-term return expectations.

- The "Multi-Asset Long View" offers long-term investors valuable insights for their portfolio composition.

to read

To paraphrase the British economist John Maynard Keynes: "It is useless to say that the storm is past when the ocean is flat again.". Many investors are currently thinking exactly that. After the 2018 market upheavals, they do not seem to see the point of considering the capital markets’ long-term prospects. However, at DWS we argue that those who look through the current storms to the distant horizon will discover solid returns potential.

This is the core message of the 100-page "DWS Multi Asset Long View", a new study that summarises DWS's expectations for individual asset classes over the next 10 years. Based on the DWS Multi-Asset & Solutions Group’s macroeconomic models and valuation standards, the analyses are primarily intended to provide long-term investors with guidance on the strategic composition of their portfolios.

Myopia doesn’t build stable portfolios

All the finance experts agree that the longer your investment horizon is, the greater will be the impact of your asset allocation on performance. The “Long View”’s central conclusion is therefore that investors should always consider asset classes’ long-term outlook when constructing their portfolios. The right choice and breakdown of asset classes is crucial for portfolios' long-term performance.

By contrast, an excessive focus on short-term trends can quickly lead investors astray. Events that appear significant on a day-to-day basis have only a minor impact on longer-term performance. For instance, the unusual phenomenon of equities and bonds oscillating in unison – as was the case at the end of last year – is unlikely to persist. This means investors should again be able to achieve better diversification.

In risk analysis and portfolio construction, investors should always focus on individual asset class fundamentals. If you look at fundamentals, it is, for example, striking that – in the US market, say – equities and corporate bonds are again valued at or even below average on a five-year perspective as a result of recent turbulence. Even measured against long-term performance in previous decades, attractive entry points have now emerged.

Make the most of the cycle

As a rule, a long-term wait-and-see investment approach is also more successful than frequent short-term reallocations. The central argument here is that investing over the long term gives individual asset classes time to complete their cycle and reach their maximum value potential.

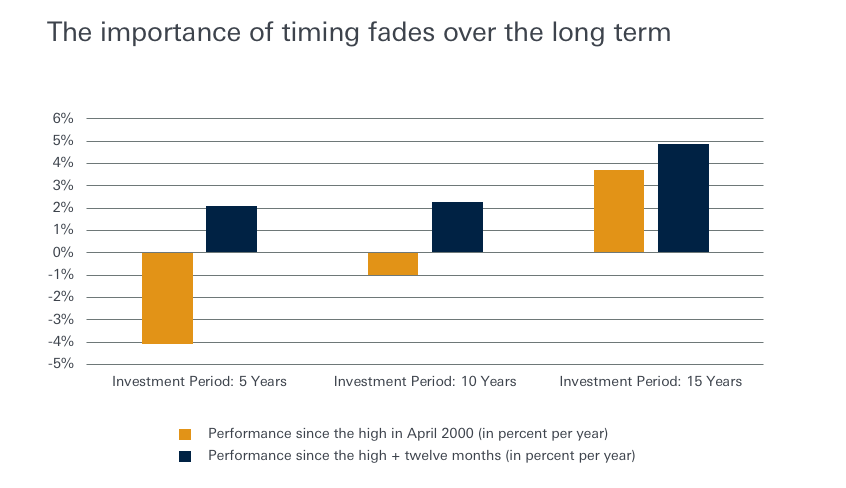

Thinking and acting for the long term pays off in investment practice more than is generally realised. Take the following example: anyone who bought shares at the peak of the dot.com boom in April 2000 suffered only a slight return disadvantage of one percentage point per year over a period of 15 years compared to an investor who bought the same shares one year later after prices had plummeted. In other words, the longer the investment period, the more the timing factor fades into the background.

Real returns depend on inflation

Ten-year estimates for real rates of return must take account of expectations for economic growth and inflation. The model calculations in the "DWS Multi-Asset Long View" assume a global rate of real growth – i.e. a nominal expansion rate minus the inflation rate – of 1.7 percent per year for the coming decade, with a global inflation rate of 1.8 percent. Behind these moderate-seeming values lurk higher figures for individual regions. For instance, we expect emerging markets to grow by an average of 3.7 percent per year in real terms, with annual inflation at 3.1 percent.

What do all these observations mean for individual asset classes? And what are the average expected returns over the next 10 years?

The overall picture that emerges from the individual analyses is that the decade of 2019 to 2029 is likely to be shaped by five trends. Investors should take these into account when constructing long-term portfolios.

1) Equities are likely to have stronger return potential than bonds. Assuming companies can on average maintain their historic earnings power, equities from developed regions such as the EU and the USA should be able to generate returns of between five and six percent per year. According to DWS estimates, absolute returns on emerging-market equities may even average eight percent per year. Moreover, they should have a significantly higher Sharpe ratio, i.e. an even better risk/return ratio.

2) For bonds, the best prospects are likely to be in the short-term credit market and eurozone high-yield bonds. Emerging-market bonds also look attractive. DWS anticipates annual returns of up to five percent for EM bonds, but it is worth noting that their risk/return ratio is roughly on a par with that of equities. Government bonds from industrialised countries, by contrast, are likely to disappoint investors. From a global perspective, public debt securities can be expected to yield no more than two percent per year.

3) The long-term outlook for commodity returns remains weak. Recent commodity price trends do not suggest that now is a compelling time to enter this asset class. DWS estimates that neither precious metals nor energy commodities such as oil will generate returns of more than two percent over the long term. In some cases, however, adding commodities to a portfolio as a diversifier may serve to spread risks more effectively.

4) In general, investors will have to take higher risks over the next decade in order to generate returns above the five-percent mark. Certain alternative investments could be considered for this purpose. A position in listed or non-listed infrastructure or in real estate funds with potential returns of between six and eight percent could, for example, pay off.

5) In the environment of generally lower returns that DWS expects, currency fluctuations present a higher risk than previously. Investors with a global portfolio will therefore have to think harder in the future about controlling currency risks, for example through hedging[1]

One thing looks clear, however: after eight consecutive years of exceptionally good financial-market conditions, the positive investment cycle appears to be coming to an end. With extremely loose interest rate policies being gradually discontinued in various regions around the world, markets are likely to become more volatile again, and the old rules for financial markets and the economy should pertain once more.

Long-term performance

|

Index |

02/14 – 01/15 |

02/15 – 01/16 |

02/16 – 01/17 |

02/17 – 01/18 |

02/18 – 01/19 |

|

S&P500 TR |

14,22 % |

-0,67 % |

22,38 % |

26,34 % |

-2,31 % |

Caption: Past performance, simulated or actual, is not a guarantee of future results. Source: Bloomberg L.P., DWS Investment GmbH, as of 31/01/2019.