- Home »

- Insights »

- Alternatives »

- Global real estate – how to find value

From a longer-term perspective, real estate looks like an increasingly plausible beneficiary of investing in inflationary times. As we previously argued, much of the space entered the current downturn, featuring hefty price corrections in some segments, admittedly at low transaction volumes, in remarkably robust health[1]. In U.S. residential, for example, rental growth has been surprisingly strong[2]. If labor markets remain robust, a return to rental growth in the course of 2023 is very likely, despite recent dips[3]. Partly, that reflects the subdued U.S. residential construction for much of the past decade. Contrary to previous booms, and to perceptions among some market commentators known for their skepticism, there simply aren’t that many imbalances to be corrected[4]. Areas such as cyclically-sensitive office markets are best considered in a regional, market-by-market or even asset-by-asset context. From an investor’s perspective, the trickier question is how to think about those segments that do have a very good decade behind them.

Take industrial real estate, which has stood head-and-shoulders above other sectors since the mid-2010s. As e-commerce swelled, companies scrambled to build distribution networks capable of rapidly fulfilling online orders. Builders could not keep up with demand, causing rents to soar, with e-commerce tenants competing for a dwindling supply of available space.

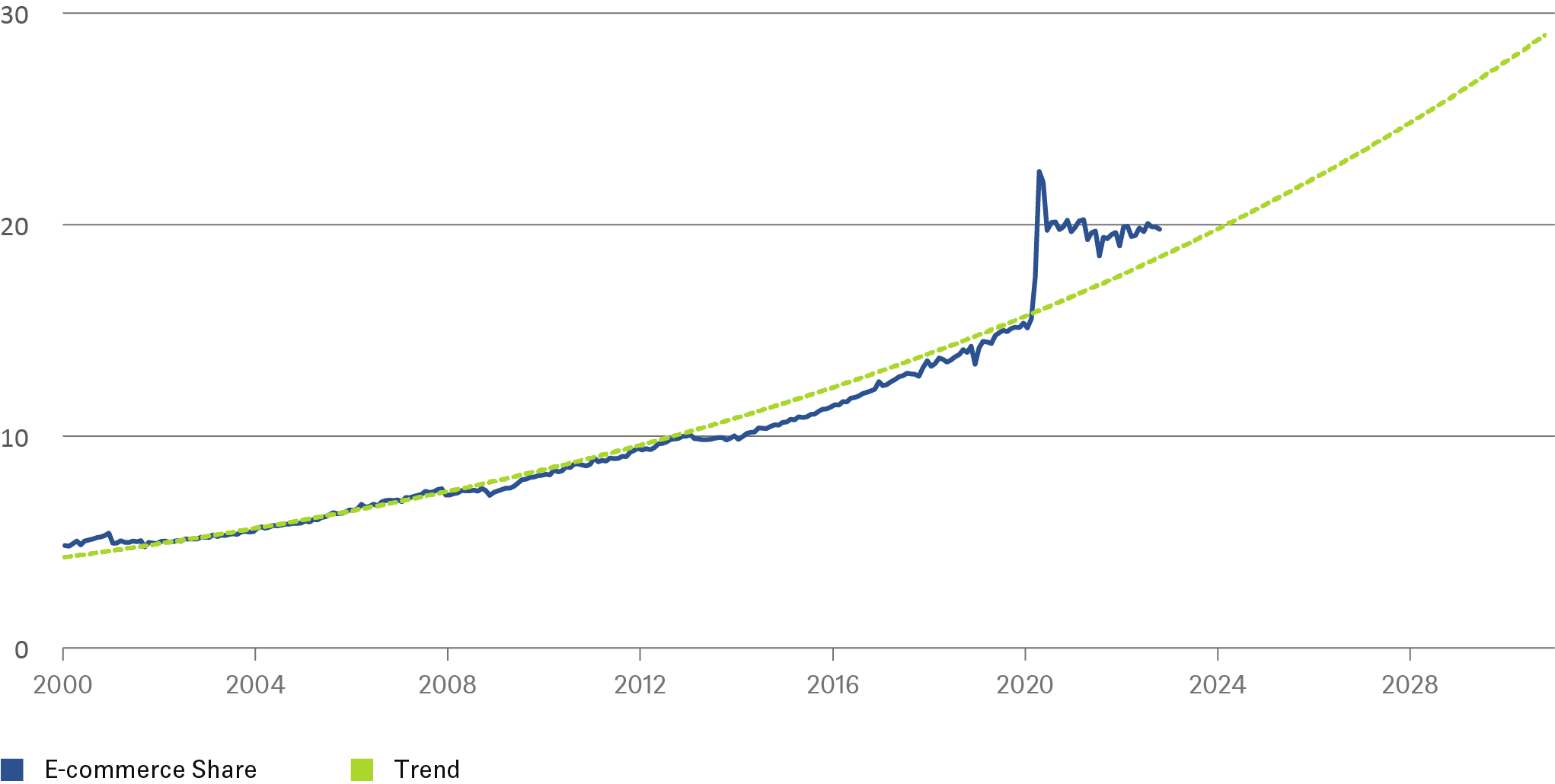

E-commerce share of U.S. retail sales*

Source: United States Census Bureau, DWS Investment GmbH as of 11/1/22

Superficially, it may seem like the bloom coming off the rose for industrial properties. Yet recent events, even beyond the banking crises, have cast a shadow over the sector. A prominent e-commerce vendor announced layoffs and plans to sublease buildings. Net new U.S. warehouse demand (or absorption) fell in 2022. And would it not seem entirely plausible for a bust to follow the boom? We do not think so. The slowdown can be readily explained: During the Covid-19 pandemic, homebound consumers shifted spending from vacations, dining, and other entertainment toward goods ordered online. E-commerce surged from 15% of U.S. retail sales (including restaurants but excluding autos and gas) in 2019 to 22% in April 2020, fueling a warehousing boom. E-commerce penetration has since drifted back to 20% as spending patterns have normalized, and industrial leasing has followed suit.

However, the sector’s underlying drivers are not only intact; in our view, they have probably strengthened. We believe that U.S. e-commerce penetration will increase to at least 25% by the end of the decade, consistent with its pre-Covid-19 trend and levels in other developed markets such as the UK. Moreover, efforts to protect supply chains from geopolitical, pandemic, and other disruptions may well have permanently increased the amount of critical inventory being held – and the space it takes to store it. To be sure, it would be a mistake to extrapolate the vagaries of the past two years to a longer-term investment horizon. Covid-19 and its aftermath temporarily accelerated, and then softened, warehouse demand. But abstracting from the recent volatility, we believe the future remains bright for industrial real estate. And if asset valuations come under renewed pressure in coming months, that could provide even more attractive entry points.