At a glance

Xtrackers ETFs by DWS is one of the world’s most established ETF providers. With a worldwide footprint and €230 billion in assets under management, Xtrackers is the largest Europe-based ETF provider and the fifth largest globally. Xtrackers has an index tracking record going back over 20 years and offers over 200 ETFs on various asset classes, including equity, fixed income, money market, currencies and commodities. With its growing number of ESG (environmental, social and corporate governance) products and in-house focus on sustainable investment analytics, Xtrackers is playing a key role in the development of socially responsible investing. Xtrackers ETFs are listed on a number of stock exchanges across Europe, Asia, and in the US, and are supported by a range of market makers.

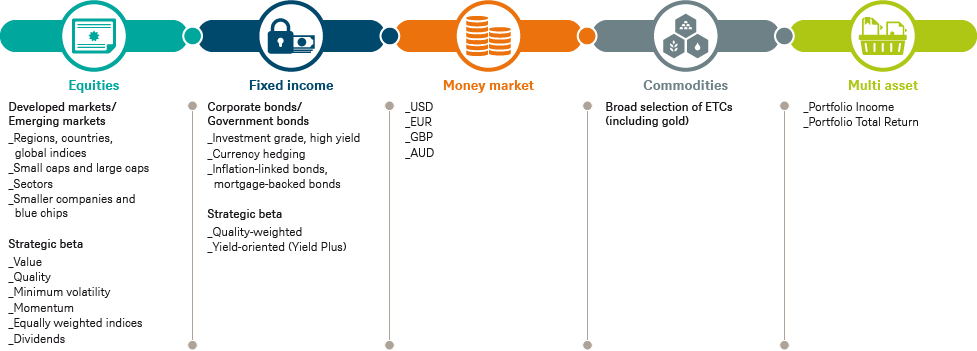

A suitable product for every investment objective

Global investment strategy, regional focus or national markets? Equities, bonds or commodities? No matter whether you invest strategically, provide for your retirement through a savings plan or aim to anticipate short-term trends – each of our more than 180 Xtrackers ETFs mirrors the performance of a well-known index. This means that you don’t just invest in a simple, transparent and diversified way, but also with flexibility and at a favourable price.

Focus topics

Our market know-how for you

As an ETF provider with global expertise, we supply our clients with regular commentaries and studies on current topics to open up new perspectives. Our DWS experts give you insights into their investment approaches, but we also support studies by independent providers that examine the market from other angles. Take a look at our current studies and analyses here.2. Sources: ETFGI as of June 2023; Based on fund volumes.

3. Morningstar, as of June 2023; Copyright © 2023 Morningstar Inc. All rights reserved. The information contained herein (1) is the intellectual property of Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.