- Home »

- Insights »

- CIO View »

- Chart of the Week »

- Italian government bonds beat Bunds

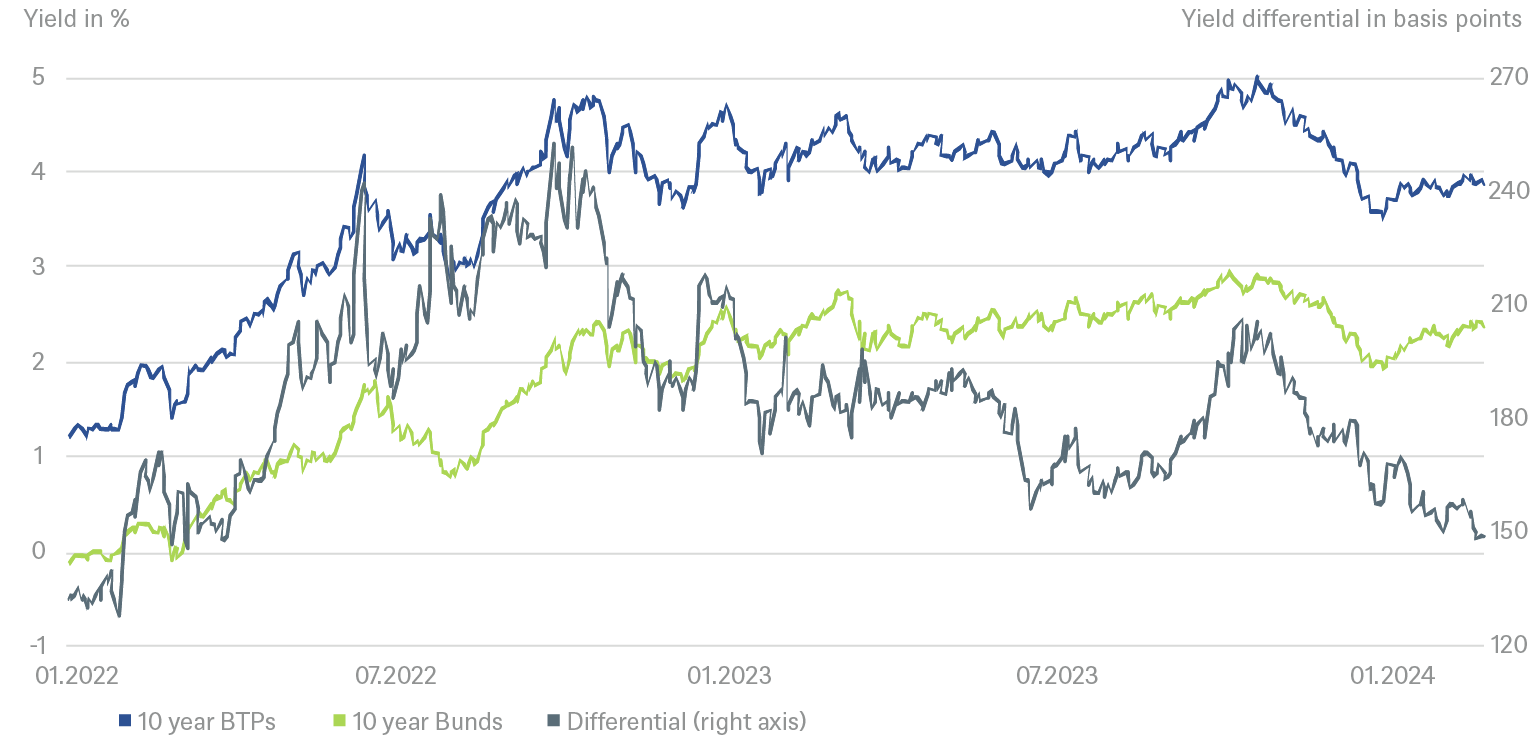

Italian government bonds (BTPs) have been outperforming their German counterparts. The yield spread over ten-year German government bonds has narrowed from around 165 basis points at the beginning of the year to just around 148 basis points at present, which is also the lowest level since March 2022.[1] We think there is a good chance that this trend will continue for at least some time.

Italian government bonds are often seen as an indicator of investor nervousness about developments in Italy itself and the wider Eurozone. When it became clear that Giorgia Meloni could become prime minister after the Italian general election in September 2022, the yield spread between ten-year Buoni del Tesoro Poliennali (BTPs) and German Bunds spiked to a peak of around 250 basis points. But since this striking high, spreads have come down significantly.

Significant drop in BTP/Bund spread

Sources: Bloomberg Finance LP, DWS Investment GmbH as of 2/20/24

It has helped that Moody's affirmed Italy's creditworthiness in November and raised its outlook to stable.[2] Moody's cited a stabilizing outlook for the economy, a healthy banking sector, and improving government debt dynamics. Italy's very low inflation rate, which in December fell to its lowest level since February 2021 at just 0.6% year-on-year, is also likely to have supported yield convergence. Germany’s inflation rate, at 2.9%, is almost five times higher.

Of course, BTPs have not escaped the current global trend of rising government bond yields as the European Central Bank (ECB) and the U.S. Federal Reserve (Fed) tackle persistently stubborn inflation with higher interest rates, amid rather resilient gross-domestic-product (GDP) growth. Since the beginning of the year the yield on BTPs has risen slightly, from 3.70% to around 3.86% now. But Italy’s outperformance of Germany has persisted.

And the search for yield seems set to continue to support Italian government bonds. Expectations that the ECB will cut interest rates this year should also keep demand for BTPs high. But there is a risk that Italy's still very high debt-to-GDP ratio, estimated at 144% in 2023,[3] could lead to investor uncertainty in the future. However, given the remaining yield premium over German Bunds, we still like BTPs.