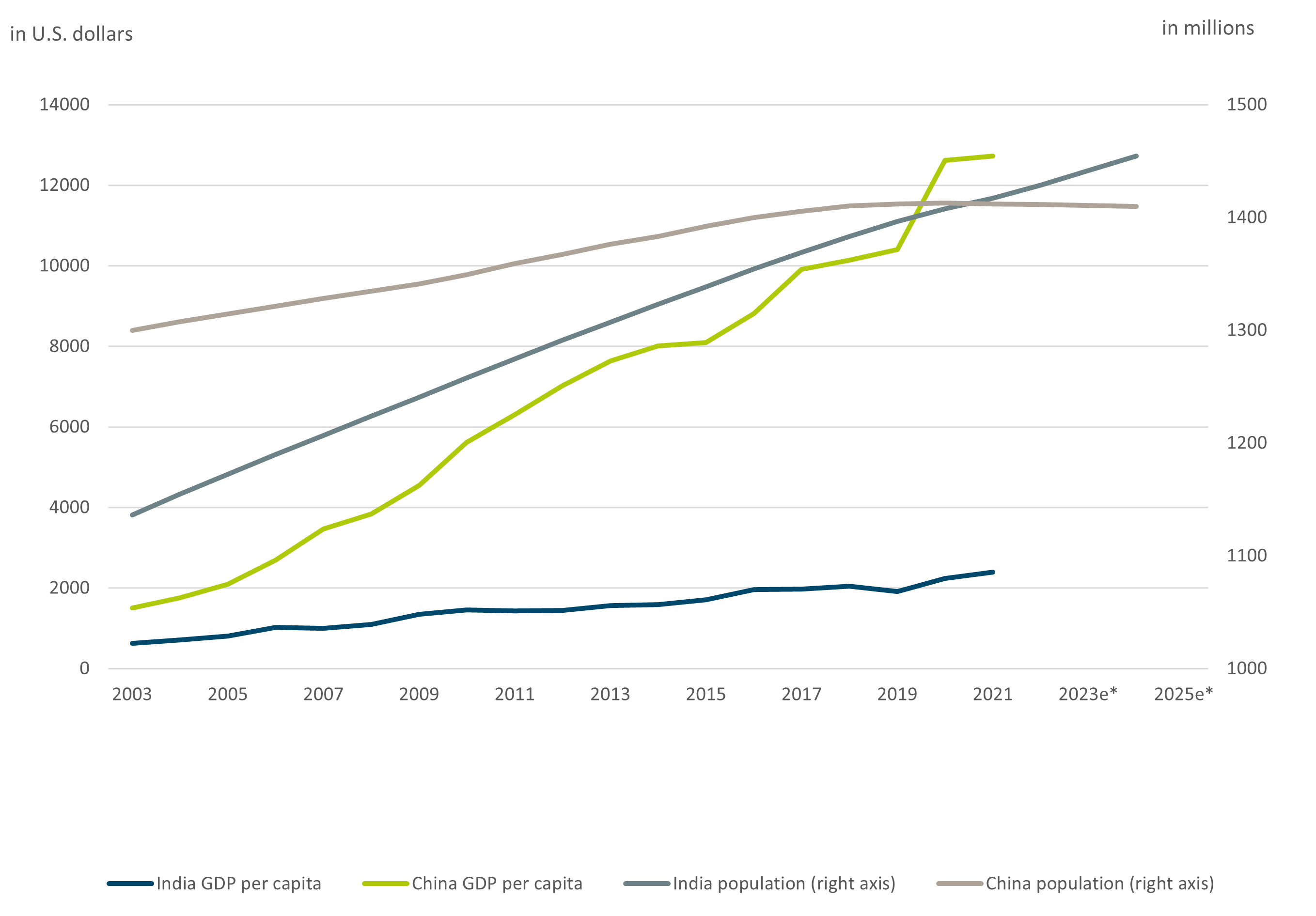

India: income catch-up potential and population growth

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 11/17/23, 2023 to 2025 figures are based on IMF estimates

India compares favorably to China

India’s fundamental advantages are best shown in contrast to China: 1) Its workforce is expected to keep growing and peak in 2040, while China’s peaked already in 2015. 2) Its big companies have received far less public support and have been exposed to more competition[1], which suggests they have become fitter. 3) The country’s catch-up potential is substantial: India’s income per capita is USD 2.5k vs China’s USD 12.7k. 4) Geopolitics: India is profiting from the growing dispute between China and the West.[2] On the other hand, China clearly leads when it comes to the speed of economic and business decision-making and implementation. Its infrastructure is more advanced and it enjoys dominance in certain sectors. However, India’s listed companies have clearly outperformed their Chinese peers over the past.[3]

National elections in 2024 could be a critical event

An important catalyst for India’s recent success has been Narendra Modi, Prime Minister since 2014. He has sped up the abolition of many formal and informal barriers to internal trade, for example by introducing the national goods-and-services tax.[4] His policy of balancing economic reforms with various social-welfare schemes is also considered a success. The upcoming elections in spring 2024 are therefore important for investors. They are likely to prefer that Modi, who is popular at present domestically, remains in power. That should increase the chances that the digitalization drive, which promises faster and higher productivity growth in various sectors, continues. But there is also a mid-term risk that political checks and balances are weakened if one party, and one leader remain in power for more than a decade.

Not cheap, but there is long-term value

India’s appeal comes at a price. The MSCI India Index has gained roughly 8% this year, outperforming Pan-Asia to which it now trades with a valuation premium of 50%[5], compared to an average of 40% over the past ten years.[6] Nonetheless, in our view, India continues to be worth considering. As we have pointed out, it has some fundamental strengths, and we also believe that international interest – and flows – to India will increase. The bond market is opening up further and India is seeking more foreign direct investment. India’s “next big thing” story does not look like a short-lived fashion.