At a glance

DWS believes in the inherent value of active investment management. Our ~410 investment professionals apply deep market expertise and global intelligence to create both core and custom solutions. Precise product design and exacting standards of execution have long been a hallmark of all our active investment strategies.

Within DWS we manage multiple strategies for our clients to meet their varied investment objectives. We constantly strive to develop innovative solutions while our truly global team of research and investment professionals is aiming to deliver superior risk-adjusted performance to our clients.

We want to be a leading active investor, who delivers alpha to our clients by leveraging our investment talent using our quantitative and fundamental approach, to capitalize on market inefficiencies in a responsible manner.

As a global asset manager, we maintain offices throughout Europe, Asia and the Americas. Main hubs are Frankfurt, New York and Singapore. We bring together a breadth of talent and resources in a structured global framework, capturing the best investment thinking, local research and investment insights from around the world.

DWS manages EUR 548bn in active management

Due to rounding, the percentages do not add up to exactly 100.

Investment process

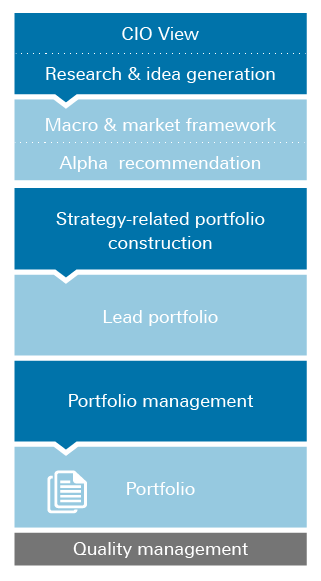

Our investment process seeks to deliver consistently superior return. It is a disciplined three stage approach, underpinned by ongoing quality management. We pursue a bottom-up approach to generate profitable investment strategies. Our consistent, systematic and transparent investment process allows us to identify those sectors, regions, themes, currencies and single stocks having the most favorable prospects.

Our economists provide a thorough analysis of the world economy and the main economic regions. Within the macroeconomic research, the major trends are identified and their impact on various components such as GDP growth, inflation, trade flows is analysed. Our research analysts focus on key market segments, issuers and securities. They provide views on the fundamental situation and offer a short- and long-term oriented assessment of the underlying market price and especially ESG factors in order to enhance risk adjusted investment performance and reputation.

Both components, macroeconomics and fundamental analysis & value assessment, are the main inputs for the CIO view (strategic and tactical view). CIO view depicts a directional world view which enables investment orientation and mind setting internally and externally. The CIO View has 2 components as well. The strategic CIO view provides long-term outlook and orientation. The tactical CIO View is a short-term assessment of key global fixed income markets. It serves as a major input factor for portfolio construction and portfolios are expected to be invested in alignment with these global CIO recommendations. In addition, the tactical CIO view puts the global CIO recommendations into a generic portfolio context and provides a relative-value asset allocation, based on a global aggregate benchmark concept.

Quality management works along the entire process and ensures outcomes get analysed and challenged by independent teams as an integral part of practice refinement and delivers transparency in analyzing the three main components: performance, risk and process – in a holistic, commingled way